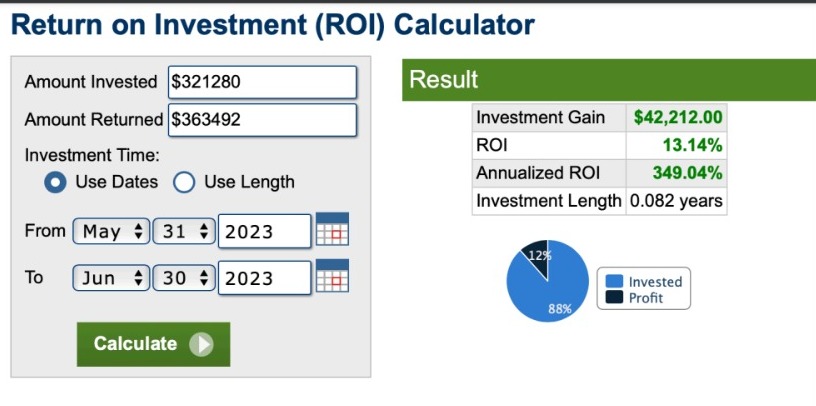

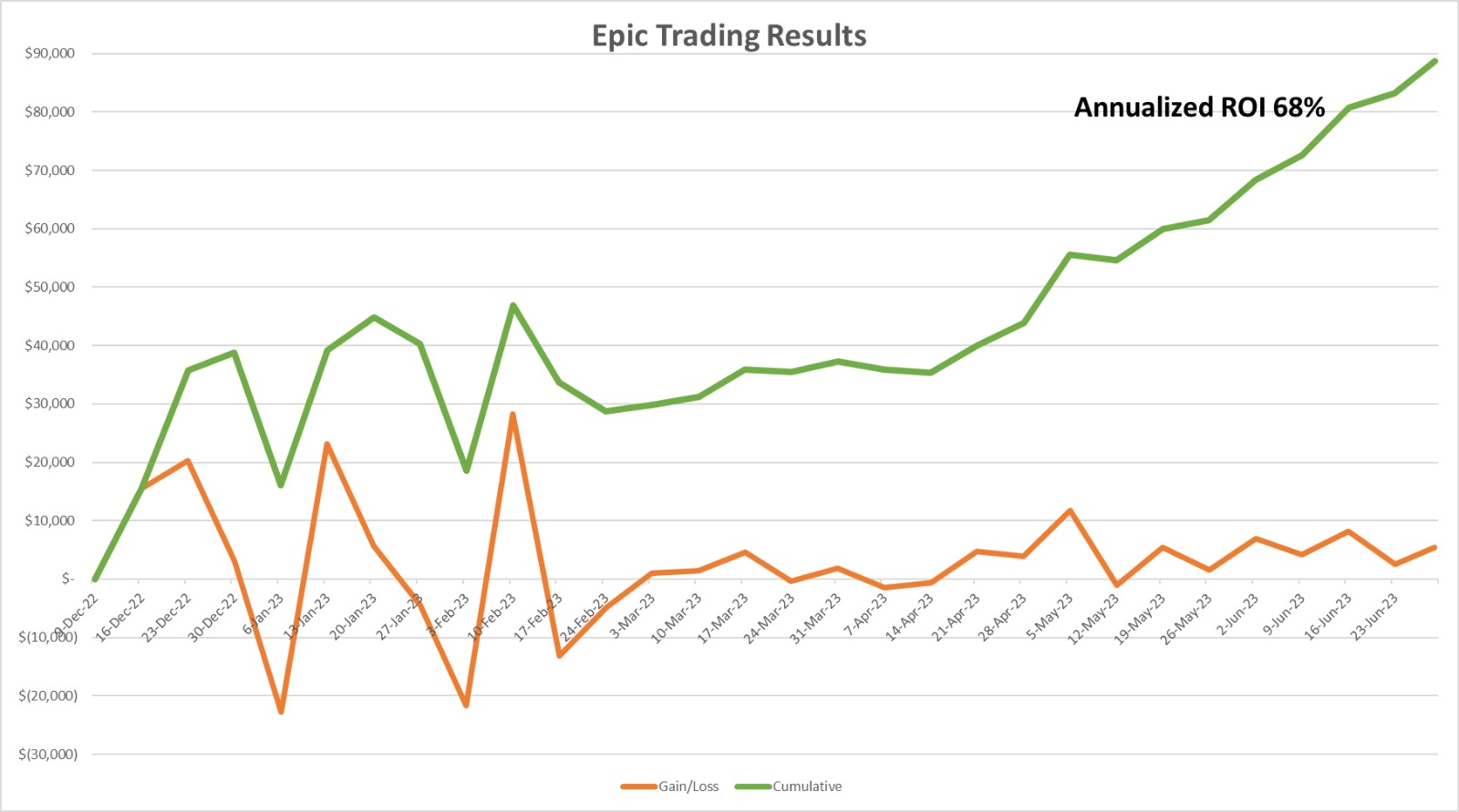

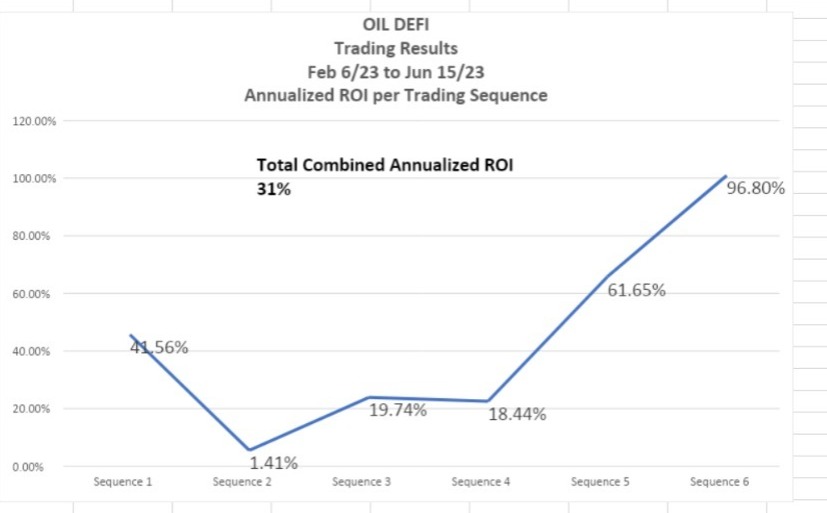

EPIC Agentic Ai Performance

At the link below you will find the most recent EPIC Agentic Ai trading performance;

For recent returns please refer to this document https://epicaihub.io/wp-content/uploads/2025/05/Agentic-AI-Data-1.xlsx.

For audited trade results contact EPIC Agentic Ai Team Here: [email protected].